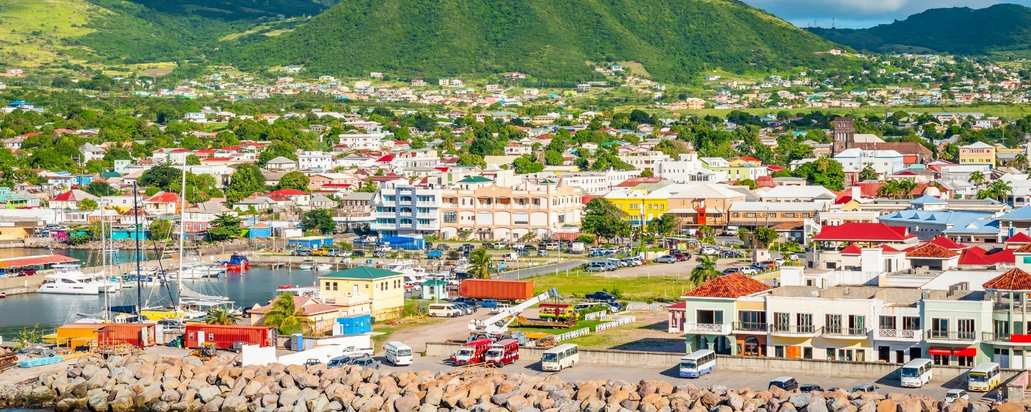

Is Nevis a Tax Haven? Exploring St Kitts and Nevis Offshore Benefits

Nevis, one of the islands forming the dual-island nation of St Kitts and Nevis, has earned a global reputation as a strategic offshore jurisdiction. Businesses and investors from across the globe are drawn here by low tax rates and a business-friendly environment. But is Nevis truly a tax haven? What makes it special among other offshore destinations? In this article, we’ll dive deep into the benefits and legal frameworks that make Nevis an attractive choice for global investors and businesses.

What Defines a Tax Haven?

A tax haven is a stable jurisdiction that offers favorable tax conditions to non-resident individuals and legal entities. Financial confidentiality standards are usually on a very high level, which adds to their popularity. Nevis not only fits this description perfectly but has much more to offer.

Characteristics of a Tax Haven

- Zero or Low Taxation Policies: Tax havens offer low/zero taxes. Similarly to other tax havens, Nevis offers zero income tax and corporate tax if 100% of profits are derived abroad. This is an ideal place to reduce your individual or corporate tax burden.

- Strict Confidentiality and Privacy Measures: The privacy standards you will find in Nevis are higher than in many other tax havens. The particulars of beneficial owners are not disclosed, which makes Nevis an optimal jurisdiction for those who value financial privacy.

- Supportive Legal Frameworks for International Businesses: Nevis has designed its legal structure to support international businesses through flexible company laws and robust asset protection regulations. Nevis-based offshore companies and trusts are particularly attractive due to the legal shields they provide to owners and beneficiaries.

Nevis in the Global Tax Haven Landscape

If we compare Nevis to other tax havens, we will see that it strikes an excellent balance between high privacy standards and compliance with global requirements. It managed to adapt to international expectations without losing any of its perks.

On the international stage, Nevis is recognized as a reliable and stable offshore jurisdiction that continues to attract businesses, individuals, and investors from around the world.

Benefits of Nevis as a Tax Haven

Let’s look at all the advantages that Nevis can offer in detail.

Zero Corporate and Income Taxes

A tax-free environment is surely an important reason why individuals and businesses flock to Nevis. The offshore operations of Nevis-based companies are totally exempt from income tax, corporate tax, or capital gains tax. No wonder HNWIs and businesses of different sizes opt for this destination to legally minimize their tax liabilities.

For individuals, the lack of income taxes means that residents of Nevis do not have to worry about paying income taxes on their global earnings, which provides a huge incentive for expatriates and retirees considering Nevis as a permanent or part-time home.

Strong Privacy Protections

While complete anonymity is a thing of the past, Nevis provides the highest possible confidentiality standards. The owners and beneficiaries of Nevis LLCs and trusts can rest assured that their identities will remain private. This feature makes Nevis a sought-after destination for those who put privacy as their first priority.

International business owners highly value the possibility of hiding their sensitive information from prying eyes, and their (absolutely legal) operations require silence. The Nevis government can only disclose the personal data of foreign investors if relevant authorities make an official request due to suspected criminal activities.

Legal Framework for Asset Protection

Nevis has a sound legal system that ensures ironclad asset protection for Nevis LLCs and trust owners. Individuals and legal entities can effectively protect their wealth from creditors and lawsuits, as there are multiple barriers for those who want to seize Nevis-based assets.

For example, the structure of Nevis LLCs provides strong protection of their members’ assets from potential lawsuits. In addition, creditors looking to pursue claims against Nevis-based companies face high legal hurdles, as the jurisdiction has established strict legal provisions that protect company members from external claims.

Furthermore, Nevis trusts are highly effective tools for estate planning and asset protection. Individuals can transfer the ownership of their assets to a legally protected trust structure and thus keep them shielded against potential creditors – especially if this is an irrevocable trust. Talk to our experts to find out more.

Business-Friendly Environment

Hassle-free company registration is one more substantial advantage of choosing Nevis. This is an ideal destination where you can establish a company quickly without unnecessary delays or endless paperwork labyrinths.

The Nevis authorities offer a lot of incentives to non-residents and do their best to create a business-friendly atmosphere. This is a jurisdiction that will help you retain your profits thanks to a low tax burden and minimize administrative work associated with a company, such as reporting.

Legal and Regulatory Framework

While Nevis offers high privacy standards, its laws are in full compliance with global requirements. It means that the jurisdiction will not be suddenly blacklisted, as sometimes happens to offshores.

Key Legislations in Nevis

The legal framework supporting the offshore industry in Nevis is robust and transparent. Two key pieces of legislation— the Nevis Business Corporation Ordinance and the Nevis Limited Liability Company (LLC) Act—provide the foundation for the island’s offshore companies.

Offshore companies in Nevis are established and operate on the basis of the Nevis Business Corporation Ordinance. It includes provisions that protect companies and their owners from legal claims and ensure that ownership information remains confidential.

Under the Nevis LLC Act, you can establish a Limited Liability Company and enjoy flexible management and bulletproof legal protection for members and assets. Nevis LLCs are highly recommendable for those who want to park their assets in a safe place.

Compliance with International Standards

Nevis ensures strong protection of confidential information and adheres to all global financial standards at the same time. Its legislation meets the requirements imposed by FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard). As a result, the jurisdiction has a high reputation as it does not allow any banned activities, such as money laundering and tax evasion, under the cover of sensitive information protection.

Anti-Money Laundering (AML) Measures

The AML measures that Nevis has adopted reliably prevent any unlawful financial operations. The financial institutions based in Nevis apply strict due diligence procedures and report suspicious transactions if they are spotted.

Nevis authorities are engaged in active cooperation with international authorities to prevent financial crimes, which helps the country maintain its reputation as a respected financial hub.

Taxation Policies in Nevis

Nevis is an ideal location for both personal and corporate tax planning.

Tax Benefits for Individuals

An individual investor who wishes to grow wealth can benefit from the absence of income tax, inheritance tax, and capital gains tax in Nevis. That is, you can retain 100% of your global earnings without paying income taxes. Nevis is also a recommended jurisdiction if you have a considerable fortune that you can pass on to your heirs, as it will be free from inheritance taxes. What is more, it can be conveniently done by forming a trust as an excellent alternative to the will. Our experts will provide all the details upon your request.

Tax Advantages for Offshore Businesses

Offshore businesses find Nevis a very attractive jurisdiction as they are not required to pay corporate tax on the condition that they generate 100% of their profits abroad. Most non-resident Nevis-based offshore companies operate globally, so they comply with this requirement and thus reduce their tax burden. This tax-free status makes Nevis a viable choice for the majority of ventures.

What is more, business owners who opt for Nevis benefit from its trouble-free incorporation process and pro-business environment.

Double Taxation Agreements

Nevis is a party to numerous double taxation agreements, which means that your company will not have to pay taxes twice on the same income. This feature makes Nevis an optimal choice for those who conduct business operations worldwide.

Non-tax residents may be liable for taxes in their home countries, and DTAs can reduce their fiscal burden in this case.

Who Benefits from Nevis as a Tax Haven?

In addition to benefiting high-net-worth individuals, Nevis’s favorable tax policies and legal protections provide a valuable advantage for entrepreneurs and business owners seeking to optimize their tax structures and secure their assets.

Individual Investors and High-Net-Worth Individuals (HNWIs)

Nevis provides an ideal environment for high-net-worth individuals and international investors who can efficiently preserve their wealth and reduce tax burden here. The tax-free policy adopted in Nevis and unbreakable asset protection with multiple barriers for those wishing to seize your assets make the place truly worth considering.

HNWIs want to manage their money in a secure and discreet manner, and Nevis’s confidentiality laws give them an opportunity to do so. We highly recommend Nevis trusts as second-to-none strongholds where your fortune will be kept intact for you or future generations.

Entrepreneurs and Business Owners

If you are an entrepreneur or a business owner who operates on a global scale, you are sure to take advantage of Nevis’s lenient tax policies. High privacy standards, business-friendly laws, and a tax-free environment make the destination an ideal place for offshore businesses, including startups and e-commerce businesses.

Multinational Corporations

Multinational corporations will surely benefit from the corporate restructuring and tax optimization that Nevis offers. Multinationals use this offshore jurisdiction in the same way as businesses of smaller size: they set up Nevis offshore companies, reduce their global tax burden, and retain more profits for expansion.

What is more, multinational corporations benefit from Nevis’s laws that make it possible to lawfully ensure unbreakable asset protection and use convenient options for corporate governance.

Nevis’s Role in the Global Offshore Ecosystem

Nevis is not only a strategic partner for investors; its booming offshore industry is an important driver of economic development and stability in the whole Caribbean region.

A Strategic Partner for International Investors

Nevis is an important player in the global offshore ecosystem. The country closely cooperates with other offshore jurisdictions to create a mutually beneficial environment for international investors. Nevis is a competitive provider of offshore business and banking services to customers worldwide.

Contribution to Economic Growth in the Caribbean

The success of Nevis as a tax haven is an important factor in the economic development of the Caribbean. The whole region enjoys stability and growth thanks to the foreign capital that Nevis attracts and its contribution to tourism industry and infrastructure.

The offshore sector plays a pivotal role in Nevis’s economy. It provides substantial revenue for the government and allows the island to remain a competitive force in the global financial market.

Aligning with Global Trends

Nevis has managed to keep up its status as a tax-efficient jurisdiction and adapt its laws to global transparency and compliance requirements. Its regulations are in line with FATCA and CRS demands, which makes the destination attractive for investors wishing to operate lawfully, adhere to global compliance requirements, and benefit from high privacy standards at the same time.

How Our Services Can Help

If you want to set up and run a company in Nevis without much hassle, take advantage of our all-inclusive service. We will help you with legal entity formation and its further maintenance.

Comprehensive Offshore Solutions

We can help you with any offshore matters, including incorporation of an LLC or an IBC or establishment of trusts in Nevis. You will become the owner of Nevis offshore companies and structures and run them without much effort on your part.

Expert Guidance for Investors

Our experts will give you advice on how to make the most of Nevis’s tax benefits tailored to your specific situation. You will be able to use optimized tax schemes and comply with global requirements at the same time. Rely on our assistance if you need a customized solution related to company establishment, asset protection, or tax burden minimization.

End-to-End Support

Your offshore ventures will receive our overall support: we will help you with initial setup and further liabilities, such as accounting or re-domiciliation if needed.

Conclusion

Nevis is a truly remarkable tax haven that combines tax benefits, high privacy standards, and pro-business laws. Entrepreneurs, high-net-worth individuals, and even multinational corporations will benefit a lot from the business growth, asset protection, and tax optimization opportunities that the country offers. With our help, you will easily make the most of Nevis’s offshore benefits.